Welcome to TechUnder5—your shortcut to mastering cutting-edge tech in under five minutes. Today’s topic: Smart Contracts, the self-executing blockchain programs that automate trustless agreements and power everything from DeFi to supply-chain tracking.

Table of Contents

- What Are Smart Contracts?

- How Smart Contracts Differ from Everyday Code?

- Pros and Cons of Smart Contracts

- When are Smart Contracts Triggered?

- Real-World Smart Contract Use Cases

- Key Takeaways

What Are Smart Contracts?

Smart contract is a self-executing program living on a blockchain that encodes “if X, then Y” agreements and automatically carries them out once its conditions are satisfied—no middleman required. Once deployed, it behaves autonomously, running exactly as written without any human intervention; is deterministic, so you can be sure it will always produce the same result given the same inputs; and operates in a trustless environment, meaning that participants don’t need to trust one another—only the underlying protocol.

Consider a crowdfunding campaign—a popular way to raise small amounts of capital from many backers via an online platform. A smart contract can automate all of its core rules:

- Deadline Enforcement Contributions are only accepted until a fixed end time; once the deadline passes, the contract simply rejects any new funds.

- Minimum Contribution Each pledge must meet a defined floor (for example, 0.01 ETH). Any amount below that threshold is automatically turned away.

- Finalization Guard Only after the deadline can the campaign be “finalized,” and this step can occur just once—eliminating the risk of duplicate payouts.

- Goal Verification Upon finalization, the smart contract compares the total raised to the funding target. If the goal is met or exceeded, it transfers all funds to the project owner.

- Refund Mechanism If the goal falls short by deadline, contributors regain their deposits. Refunds open only after the campaign ends—and only for those who actually backed it.

- Safety Against Reentrancy Before issuing any refund, the contract zeroes out the backer’s balance to prevent malicious re-entry attempts from draining funds.

By enforcing “require X, then proceed” logic at each step, the smart contract guarantees that payouts or refunds happen only when every prewritten condition is satisfied—ensuring a predictable, secure crowdfunding process.

How Smart Contracts Differ from Everyday Code?

You might be wondering: aren’t smart contracts just “if-this-then-that” scripts like any other code? At their core, smart contracts do follow “if X, then Y, else Z” logic—but what truly distinguishes them is where they run, how they execute, and why we use them.

| Everyday Code | Smart Contracts |

|---|---|

|

• Runs on your local machine or a server you control. • Execution can be stopped, modified, or rolled back by the server owner. |

• Deployed on a distributed blockchain network. • Immutable and trustless—no one can stop or alter execution once live. |

|

• Software updates and patches are common and straightforward. • Code changes are managed by administrators. |

• Code is permanent on-chain—cannot be changed after deployment. • Fully auditable by anyone, guaranteeing transparency. |

|

• Uses external payment gateways or databases for money transfers. • Relies on trusted third parties for transactions. |

• Can lock up and release cryptocurrency natively. • Executes value transfers atomically without intermediaries. |

|

• A single server determines the result. • No built-in consensus mechanism. |

• Every node re-executes the same logic and must agree via consensus. • Ensures deterministic outcomes at the cost of gas. |

|

• Bugs can be patched or rolled back easily. • Live debugging and hot fixes are possible. |

• Bugs can permanently lock or drain real funds. • Requires formal audits, extensive testing, and safety patterns. |

|

• Code runs until you terminate the process or hit system limits. • No per-operation cost. |

• Each operation (storage, loops, etc.) consumes gas. • Forces lean, predictable logic to avoid unbounded loops. |

In essence, while smart contracts use familiar “if-this-then-that” logic, running that logic on a decentralized, immutable ledger turns basic branching into trustless, self-executing agreements. Without smart contracts, a blockchain is merely a tamper-proof record; with them, it becomes a global, autonomous computer.

Pros and Cons of Smart Contracts

| Pros | Cons |

|---|---|

| ✅ Trustless automation | ⚠️ Irreversible bugs (e.g., lost funds) |

| ✅ 24/7 execution | ⚠️ Scalability limits & gas costs |

| ✅ Transparent audit trail | ⚠️ Oracle dependency (off-chain data risk) |

| ✅ Permissionless innovation | ⚠️ Regulatory uncertainty |

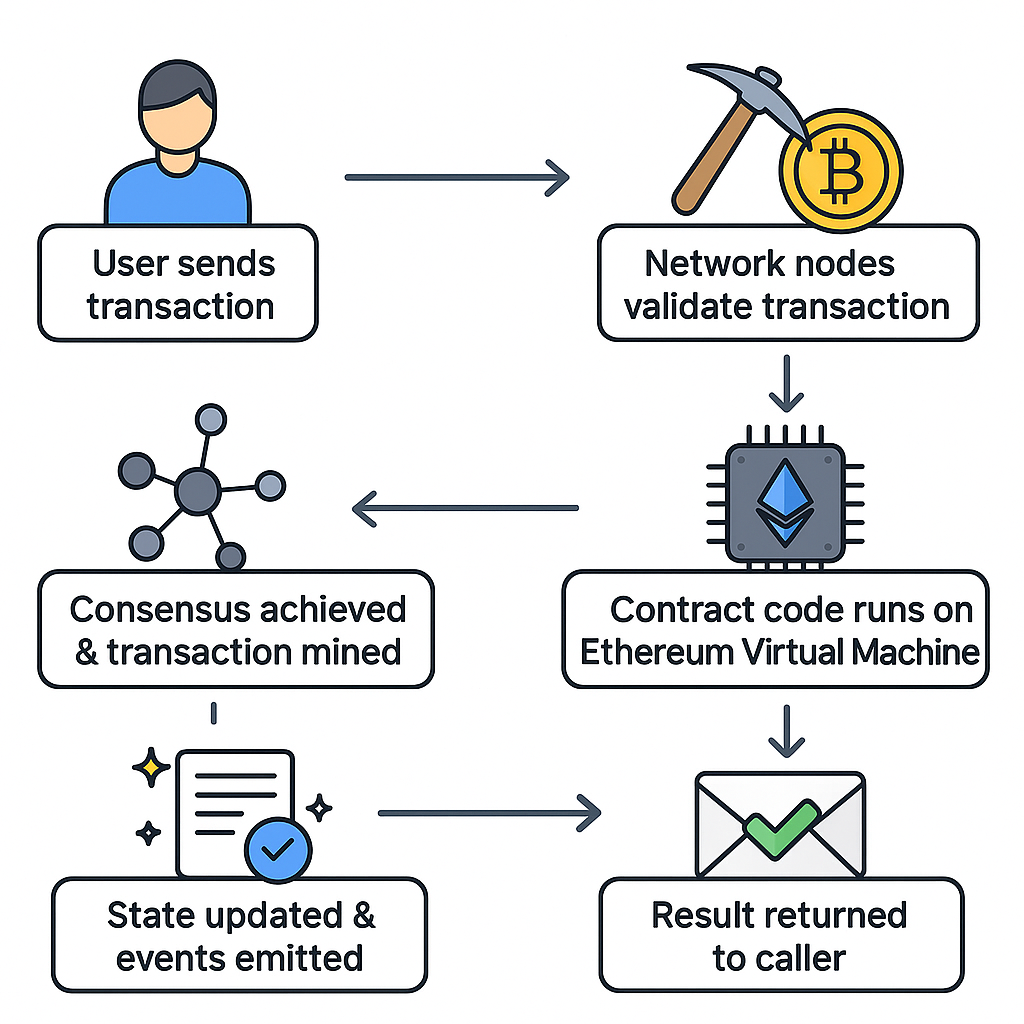

When are Smart Contracts Triggered? (Ethereum Example)

Real-World Smart Contract Use Cases

| Use Case | Description |

|---|---|

| DeFi Lending (Aave, Compound) | Users lock up cryptocurrency as collateral to borrow other assets or earn interest—no bank required. |

| AMMs & DEXs (Uniswap, SushiSwap) | Automated liquidity pools match trades and set prices via smart contracts instead of traditional order books. |

| Parametric Insurance (e.g., flight delay payouts) | Policies automatically pay out when an on-chain data feed confirms a predefined event, such as a delayed flight. |

| Supply Chain Tracking (Walmart – food provenance) | Each step of a product’s journey is immutably recorded on-chain for transparent, tamper-proof provenance. |

| NFT Royalties (automated artist payouts) | Every secondary sale of a digital collectible triggers an on-chain royalty payment back to the creator. |

| Tokenized Real Estate (fractional ownership + rent distribution) | Property shares are represented as tokens, enabling proportional profit and rent distribution via smart contracts. |

Key Takeaways

Smart Contracts turn simple “if … then” rules into trustless, on-chain automation—no middlemen required. They power everything from DeFi and insurance to supply-chain tracking and NFT royalties, making blockchains truly programmable.

If you found this guide helpful, like, share, and subscribe to TechUnder5.