TechUnder5 — where tech meets simplicity, fast. Today, we’re diving into one of the hottest—and most controversial—topics in digital collectibles: NFTs and why they lost their value.

🎬 Watch the Video for the Full Breakdown

What Are NFTs?

NFTs, or Non-Fungible Tokens, are unique digital certificates stored on a blockchain that prove you own a one-of-a-kind asset—whether that’s a piece of digital art, a collectible trading card, or even virtual real estate.While cryptocurrencies like Bitcoin or Ether are fungible (every coin is identical and interchangeable), NFTs are non-fungible: each token carries its own unique ID and metadata. That means one NFT can’t be swapped for another as equals, making them perfect for representing scarce or exclusive items.

To mint an NFT, you simply upload your image or video to a decentralized storage system (such as IPFS), create a tiny metadata file that describes and links to that media, and then call an NFT smart contract (e.g., ERC-721) on the blockchain. Once the transaction is confirmed, that smart contract issues a token whose on-chain record permanently points to your media—instantly turning your JPEG, GIF or MP4 into a verifiable, one-of-a-kind digital asset.

Think of it like this: you could mint the exact same digital drawing twice, but each NFT becomes its own one-of-a-kind token whose value is driven entirely by who owns it, the hype around it, and what a buyer’s willing to pay.

Why NFTs Took Off

- Scarcity & Provenance

- Each NFT has a unique ID and metadata.

- Buyers could prove they own “the original” digital item.

- Creator Royalties

- Smart contracts can be coded to auto‐pay artists a percentage on every resale.

- Speculation & Hype

- Celebrity drops, viral collections (think CryptoPunks, Bored Ape Yacht Club).

- FOMO drove prices sky-high.

- New Revenue Streams for Creators

- Digital artists, musicians, and brands found fresh monetization channels.

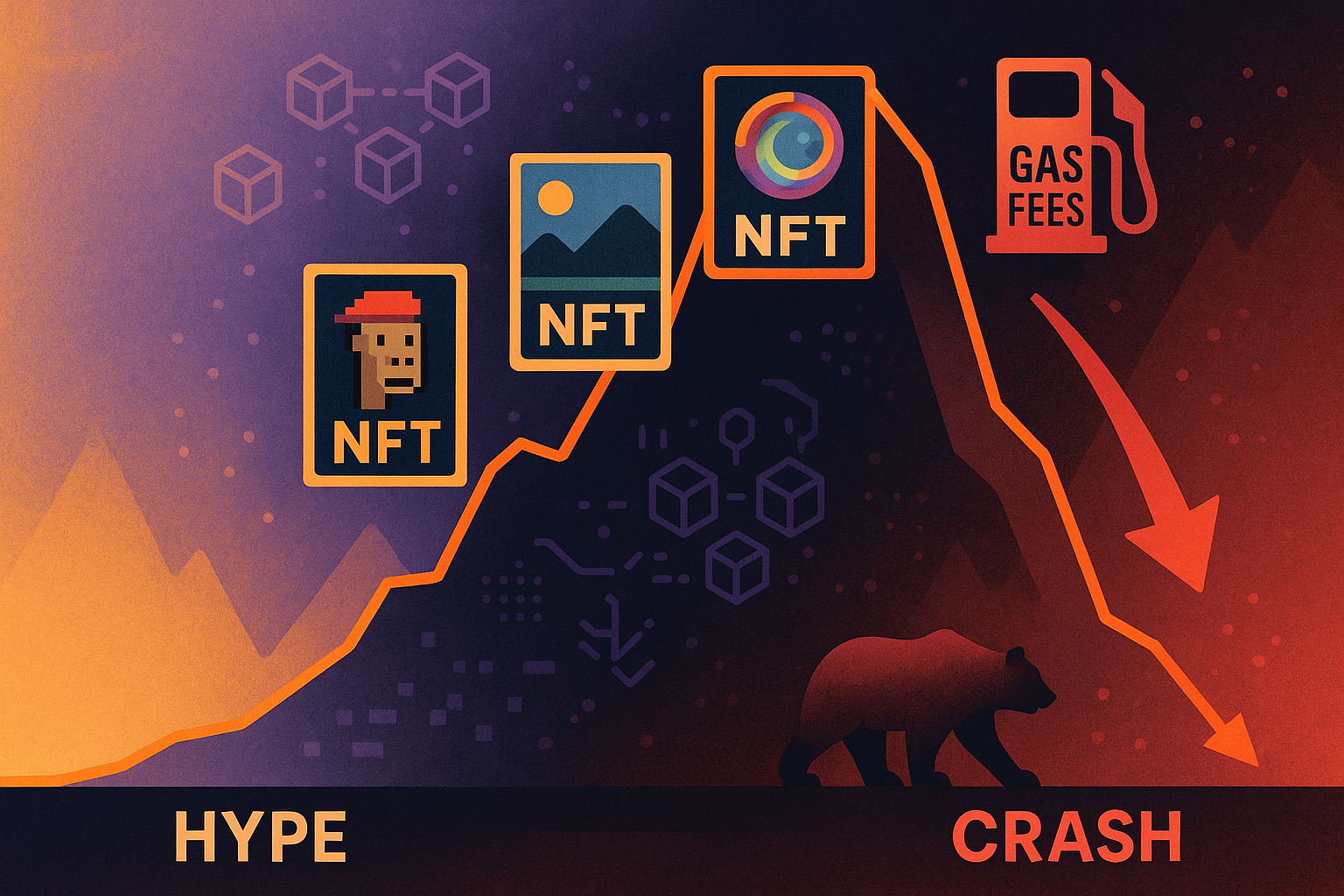

Why NFTs Lost Their Value

Despite an explosive start, the NFT market eventually ran into a series of headwinds that dampened its momentum. Early on, a flood of look-alike collections saturated the marketplace, making it hard for any single project to stand out amid rampant speculation. As the novelty wore off, buyers began to notice that many NFTs offered little beyond the bragging rights of ownership—few came with tangible perks, exclusive access, or practical applications, so enthusiasm waned.

At the same time, astronomical gas fees on Ethereum turned routine minting or trading into a costly gamble, pricing out many casual participants and slowing transaction volume. When the initial frenzy subsided, those high‐price bids disappeared almost overnight, triggering a market correction that dropped prices across the board. Trust suffered further blows from a slew of scams, phishing attacks and “rug pull” schemes that left investors out of pocket, while growing awareness of blockchain’s environmental footprint prompted eco-minded collectors to step back. Together, these factors combined to transform a blistering boom into a broad and lasting downturn.

Key Insight:

NFTs aren’t inherently valuable―value comes from scarcity, utility, and community trust. When those pillars weaken, prices follow.

What Are Gas Fees—and Why They Complicate Minting?

Gas fees are the transaction costs you pay to process actions on an Ethereum-style blockchain. Every operation—sending ETH, trading tokens, or minting an NFT—requires computational work by the network’s validators (or “miners” on proof-of-work chains). Gas fees compensate them for that work, measured in “gwei” (a tiny fraction of one ETH).

Why High Gas Fees Make Minting Tough

-

Unpredictable Costs

Gas prices fluctuate wildly with network demand. During peak traffic, fees can spike from a few dollars to tens or even hundreds of dollars per transaction, making it hard to budget for minting costs. -

Barrier for Small Creators

If minting your art or collectible routinely costs $50–$100, many emerging artists and hobbyists are effectively priced out of launching new NFTs. -

Risk of Failed Transactions

Underpriced gas can leave your transaction stuck or dropped, forcing you to resend with higher fees—and sometimes doubling your cost if you misestimate. -

User Friction

High fees turn away casual buyers and collectors who don’t want to spend more on gas than on the actual artwork, slowing marketplace activity and adoption.

By moving to proof-of-stake networks or Layer-2 rollups, many projects aim to dramatically lower these fees—making minting affordable even when the ecosystem heats up.

Lessons for the Future

-

Focus on real-world utility.

NFTs should offer more than digital bragging rights—link them to tangible assets, unlock exclusive events or content, and deliver ongoing benefits that keep holders engaged. -

Choose sustainable platforms.

Favor proof-of-stake chains or Layer-2 solutions that drastically reduce gas fees and carbon emissions, making it easier and greener to mint, trade, and interact. -

Build strong communities and governance.

Projects that empower users with transparent roadmaps, regular updates, and on-chain voting mechanisms foster trust and long-term value retention. -

Practice thorough due diligence.

Before buying, research the team’s track record, scrutinize the project’s roadmap and tokenomics, and verify that smart contracts have been audited by reputable firms.

Wrap-Up from TechUnder5

NFTs showed us the power of programmable ownership—but also the perils of unchecked hype. Next time you hear about a new drop, ask: “What utility does this really deliver?”

Found this helpful? Share, bookmark, and subscribe to TechUnder5 on YouTube for more bite-sized tech explained.