Welcome to TechUnder5 — where tech meets simplicity in just under 5 minutes!

When it comes to trading crypto, you have two main choices — Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). But which one gives you more control, security, and flexibility? Let’s break it down in simple terms

Table of Contents

- What is a Centralized Exchange (CEX)?

- Real-World Analogy for CEX

- What is a Decentralized Exchange (DEX)?

- Real-World Analogy for DEX

- CEX vs DEX – Pros Comparison

- CEX vs DEX – Cons Comparison

- Short-Term vs Long-Term Strategy

- Conclusion

What is a Centralized Exchange (CEX)?

A Centralized Exchange (CEX) is a crypto trading platform run by a company.

You create an account, deposit money or crypto, and the exchange holds it for you — similar to how a bank operates.

Key Features of CEX:

- Smooth, beginner-friendly experience

- Fast trades with high liquidity

- Access to hundreds of cryptocurrencies

They also manage your security keys, process trades, and offer customer support.

Real-World Analogy for CEX

Think of a CEX like a currency exchange counter at an airport:

- You hand over dollars, they give you euros.

- They keep records, process the exchange, and hold your money until you take it back.

- You trust the counter to do its job — but they are in control.

What is a Decentralized Exchange (DEX)?

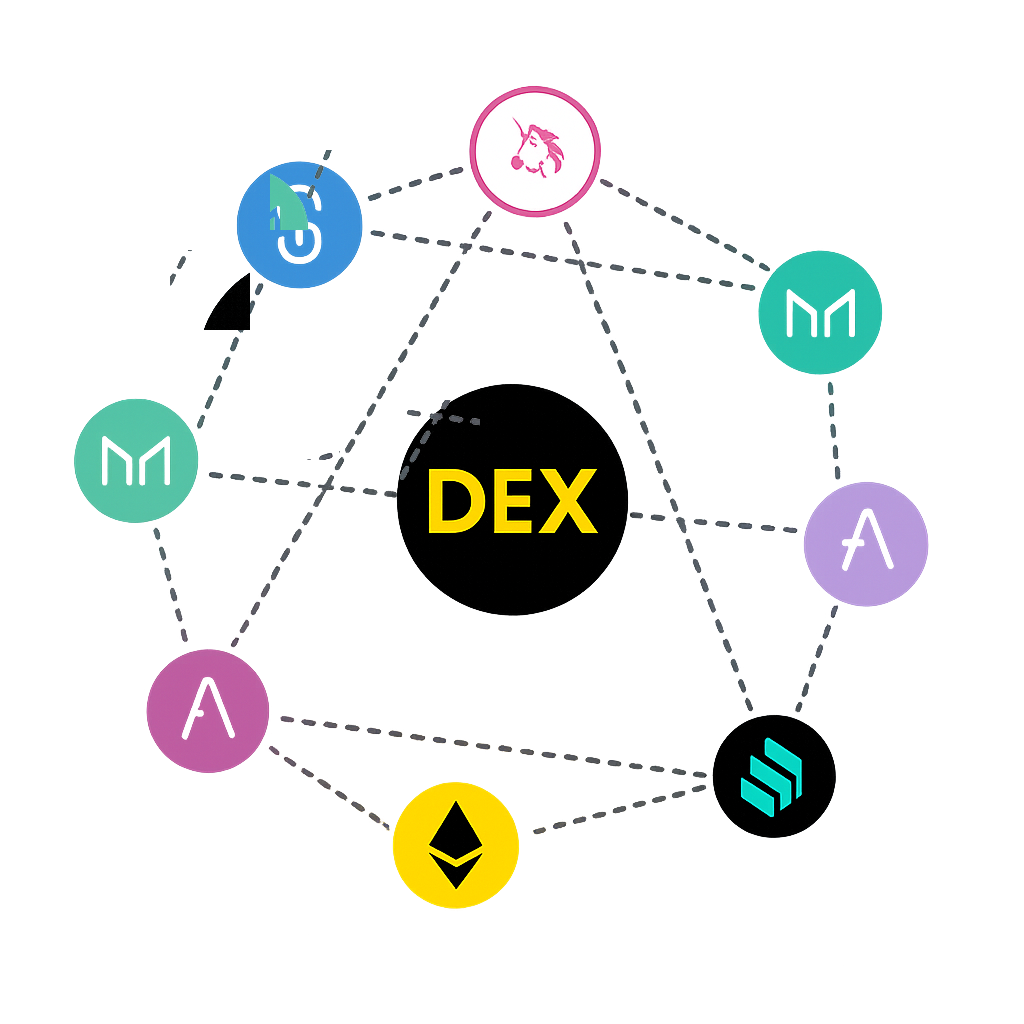

A Decentralized Exchange (DEX) removes the middleman — not even the platform controls your funds.

Here’s how it works:

- You connect your own wallet to trade directly on the blockchain.

- No sign-ups, no KYC, no centralized authority.

- Trades are executed via smart contracts — bits of blockchain code that handle token swaps, fees, and more.

- Many DEX platforms are open-source and community-governed.

Popular examples: Uniswap, PancakeSwap, dYdX.

Real-World Analogy for DEX

A DEX is like hosting a garage sale:

- Anyone can walk by, browse, and make a deal.

- No staff, no store — just direct trading between people.

- You have full freedom and full control — but also full responsibility.

CEX vs DEX – Pros Comparison

✅ Centralized Exchanges (CEX)

- Easy to use, beginner-friendly – CEX platforms are designed with intuitive interfaces and guided workflows, making them ideal for newcomers to crypto who may not be familiar with blockchain technology.

- Fast transactions and high liquidity – Because CEXs aggregate a large number of buyers and sellers, trades are executed quickly and at competitive prices, reducing slippage.

- Customer support for issues – If something goes wrong, such as a failed deposit or mistaken trade, you can contact support teams for assistance — a safety net that DEXs typically lack.

- Allows fiat purchases via cards and bank transfers – CEXs bridge the gap between traditional finance and crypto, letting you buy coins directly with USD, EUR, or other fiat currencies using debit cards, credit cards, or bank accounts.

✅ Decentralized Exchanges (DEX)

- You control your funds at all times – With DEXs, your crypto stays in your personal wallet until the trade is executed, removing the risk of an exchange freezing or losing your assets.

- More privacy, no ID verification required – DEXs typically don’t require KYC (Know Your Customer) checks, allowing you to trade without handing over sensitive personal information.

- Access to smaller or early-stage tokens – Many new or niche cryptocurrencies launch on DEXs before making it to big centralized platforms, giving you early access to emerging projects.

- Censorship-resistant — trades can’t be blocked – Because trades are executed on the blockchain through smart contracts, no authority can prevent a transaction from taking place.

- Borderless — trade anywhere with internet + wallet – All you need is an internet connection and a crypto wallet; location restrictions and banking barriers don’t apply.

CEX vs DEX – Cons Comparison

❌ Centralized Exchanges (CEX)

- You don’t hold your private security keys (risk of frozen/lost funds) – In a CEX, the exchange holds your private keys, meaning they have ultimate control over your funds. If the platform freezes your account, faces bankruptcy, or suffers a technical failure, you could lose access to your assets.

- Prone to hacks or insider fraud – Centralized platforms act as large “honey pots” for hackers, making them attractive targets. There have also been cases where insiders have misused their access to steal funds.

- Limited token availability – A CEX decides which cryptocurrencies to list based on internal policies, regulatory concerns, and market demand, meaning you might not find smaller or newer tokens.

- Subject to regulation and location restrictions – Many CEXs block or limit service to certain countries due to legal requirements, leaving some users unable to open accounts or trade freely.

❌ Decentralized Exchanges (DEX)

- Steeper learning curve, complex UI – DEX interfaces often assume some knowledge of wallets, blockchain transactions, and token standards, which can be overwhelming for beginners.

- No customer support if you make a mistake – If you send funds to the wrong address or interact with the wrong contract, there’s no centralized help desk to reverse the transaction.

- Gas fees (also known as transaction fees) can spike during network congestion – On blockchains like Ethereum, busy periods can cause fees to soar, making small trades uneconomical.

- Smart contract bugs can cause fund loss – Since trades are governed by blockchain code, vulnerabilities in the smart contracts can be exploited by attackers, leading to loss of funds if the code isn’t well-audited.

Short-Term vs Long-Term Strategy

Short-Term (CEX)

- Great for quick buys with a card – If you need to purchase crypto instantly using a debit card, credit card, or bank transfer, CEX platforms offer the fastest on-ramp from traditional money to digital assets.

- High liquidity for fast trades – Centralized exchanges usually have large order books with many active buyers and sellers, allowing you to execute large trades quickly and at competitive market prices without significant slippage.

Long-Term (DEX)

- Ideal for storing assets securely without third-party risks – By keeping your assets in your own wallet and trading through a DEX, you avoid the dangers of exchange freezes, bankruptcies, or centralized hacks.

- Many traders buy on a CEX and move funds to a private wallet or DEX – This hybrid approach combines the convenience of CEX purchases with the self-custody and security of decentralized storage, giving you the best of both worlds for long-term holding.

Conclusion

A CEX is like a bank — easy, centralized, and controlled.

A DEX is like a marketplace — free, self-managed, but riskier.

The choice comes down to control vs convenience.

Which one do you prefer? Team CEX or Team DEX?